ESG Investing: finding your motivation

10 March 2021

Environmental, social, and governance (ESG) factors are a set of criteria that can be used to rate companies alongside traditional financial metrics.

Awareness around this practice has risen substantially in recent years, but how can investors determine if it’s a good fit for their portfolio?

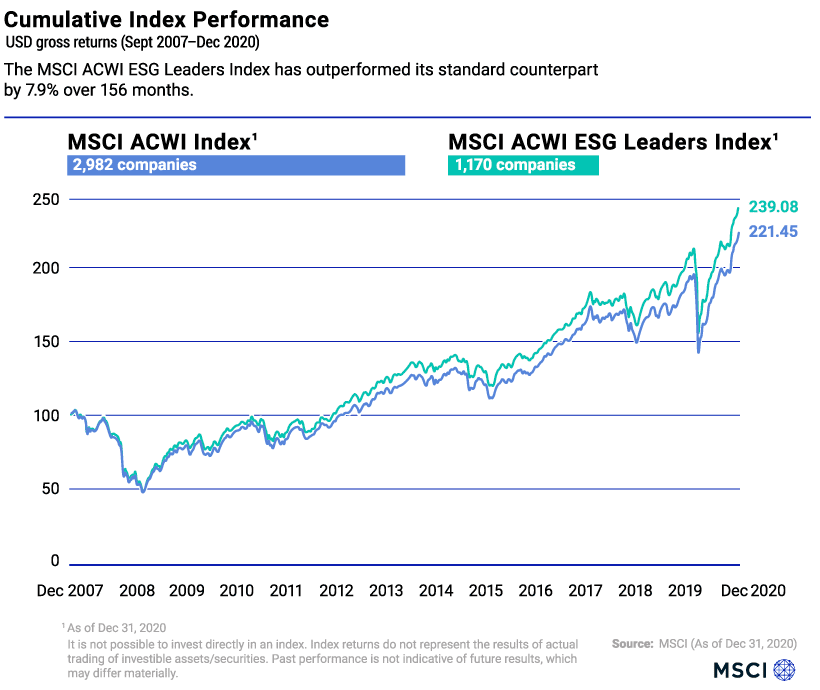

To answer this question, MSCI has identified three common motivations for using ESG in one’s portfolio, which have been outlined in the graphic above.

The three motivators

According to this research, the three primary motivations for ESG investing are defined as ESG integration, incorporating personal values, and making a positive impact.

These goals are not mutually exclusive, though, and an investor may relate to more than just one.

#1: ESG integration

This motivation refers to investors who believe that using ESG can improve their portfolio’s long-term results. One way this can be achieved is by investing in companies that have the strongest environmental, social, and governance practices within their industry.

These companies are referred to as “ESG leaders”, while companies at the opposite end of the scale are known as “ESG laggards”. From a social perspective, an ESG leader could be a firm that promotes diversity and inclusion, while an ESG laggard could be a company with a history of labor strikes.

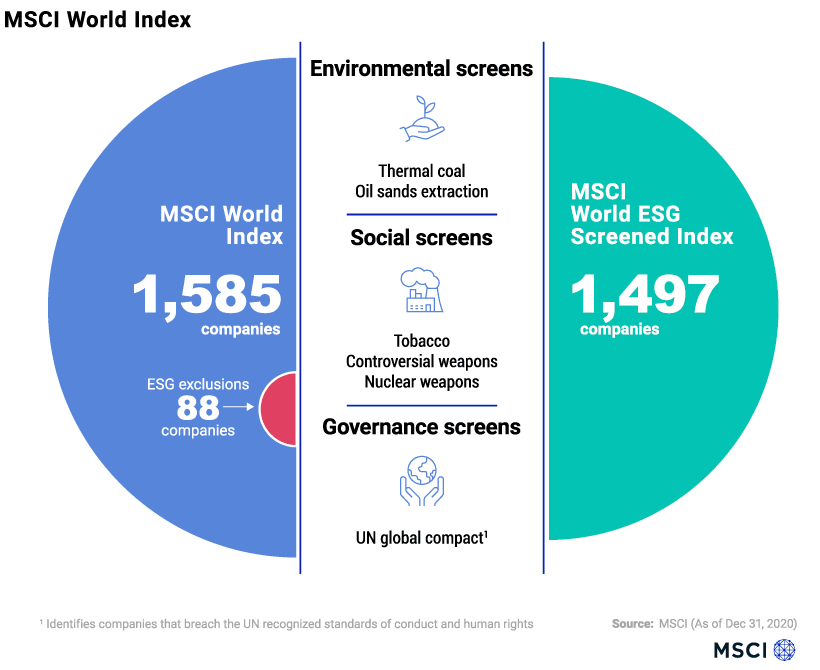

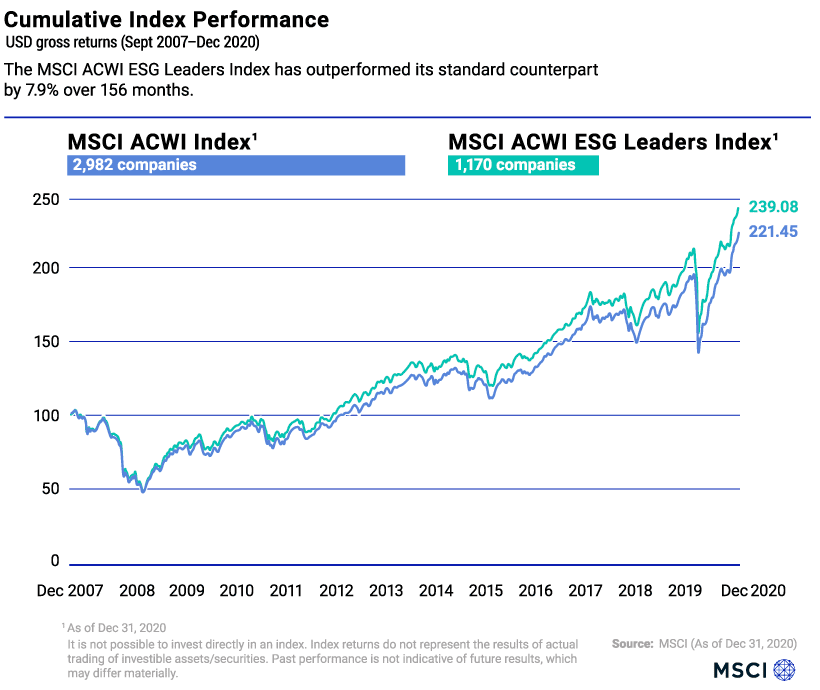

To show how ESG integration may lead to better long-term results, we’ve compared the performance of the MSCI ACWI ESG Leaders Index with its standard counterpart, the MSCI ACWI Index, which represents the full opportunity set of large- and mid-cap stocks across developed and emerging markets.

The MSCI ACWI ESG Leaders Index targets companies that have the highest ESG rated performance in each sector of its standard counterpart. The result is an index with a smaller number of underlying companies (1,170 versus 2,982), and a relative outperformance of 7.9% over 156 months.

#2: Incorporating personal values

ESG investing is also a powerful tool for investors who wish to align their financial decisions with their personal values. This can be achieved through the use of negative screens, which identify and exclude companies that have exposure to specific ESG issues.

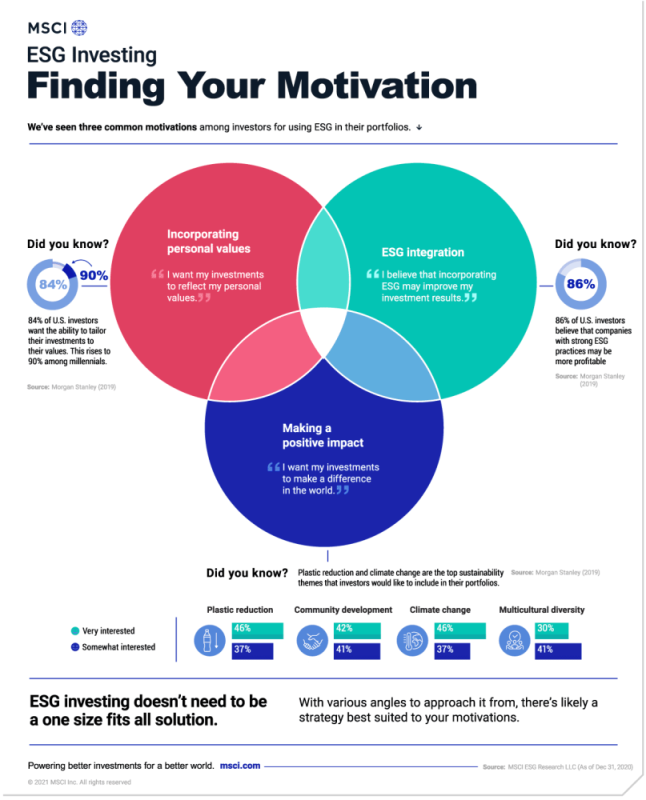

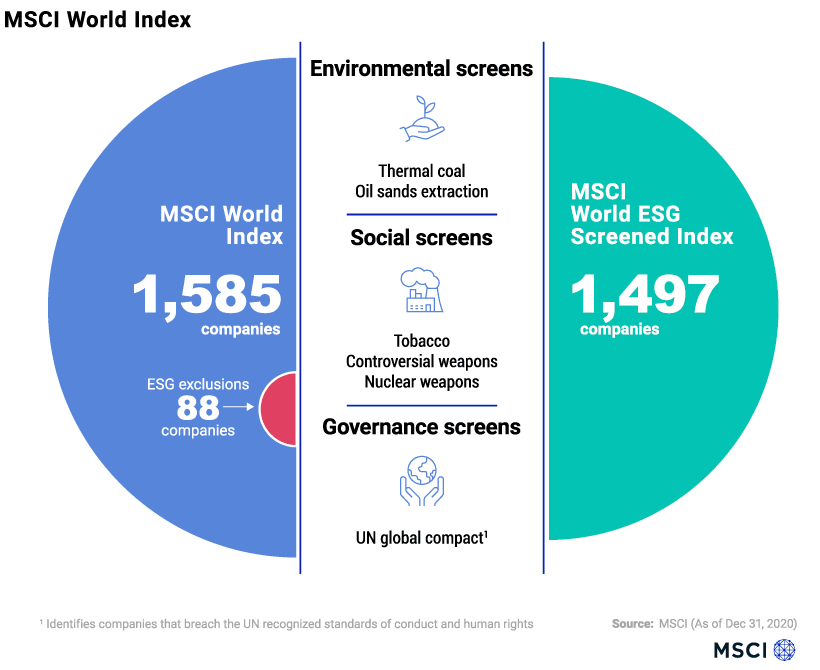

To see how this works, we’ve illustrated the differences between the MSCI World ESG Screened Index and its standard counterpart, the MSCI World Index.

The MSCI World ESG Screened Index excludes companies that are associated with controversial weapons, tobacco, fossil fuels, and those that are not in compliance with the UN Global Compact. The UN Global Compact is a corporate sustainability initiative that focuses on issues such as human rights and corruption.

#3: Making a positive impact

The third motivation for using ESG is the desire to make a positive impact through one’s investments. Also known as impact investing, this practice enables investors to merge financial gains with environmental or social progress.

Investors have a variety of tools to help them in this regard, such as the MSCI Women’s Leadership Index, which tracks companies that exhibit a commitment towards gender diversity. Green bonds, bonds that are issued to raise money for environmental projects, are another option for investors looking to drive positive change.

ESG investing for all

With various angles to approach it from, ESG investing is likely to appeal to a majority of investors. In fact, a 2019 survey found that 84% of U.S. investors want the ability to tailor their investments to their values. Likewise, 86% of them believe that companies with strong ESG practices may be more profitable.

Results like these underscore the high demand that U.S. investors have for ESG investing—between 2018 and 2020, ESG-related assets grew 42% to reach $17 trillion, and now represent 33% of total U.S. assets under management.

Source from www.visualcapitalist.com